Lead Authors: Dr. Sajjad Ahmad Jan and Dr. Fahim Nawaz

Layout and Information Design: Mr. Ikram Ghani

Published By: Development Insights Lab (DIL), October 25, 2023

Acknowledgment

We would like to thank all those who contributed information and technical support to this research.

- Mr. Ikram Ghani, for setting up the data tables and providing technical and digital assistance.

- Mr. Haris Shinwari, a Ph.D. scholar; Mr. Ahmad Khan and Mr. Muhammad Umar, MPhil scholars; and the BS students from the Department of Economics at the University of Peshawar (Ms. Iraj Iqbal, Ms. Amina Kamal, Mr. Shahab-ud-Din, Mr. Talha Javed Siddiqui, Mr. Hafiz Syed Affan Banuri, Mr. Aimal Yar Saleem, Mr. Muhammad Jafar, Mr. Ansar Khan, and Mr. Ali Khan)for their assistance in collecting the data.

Summary

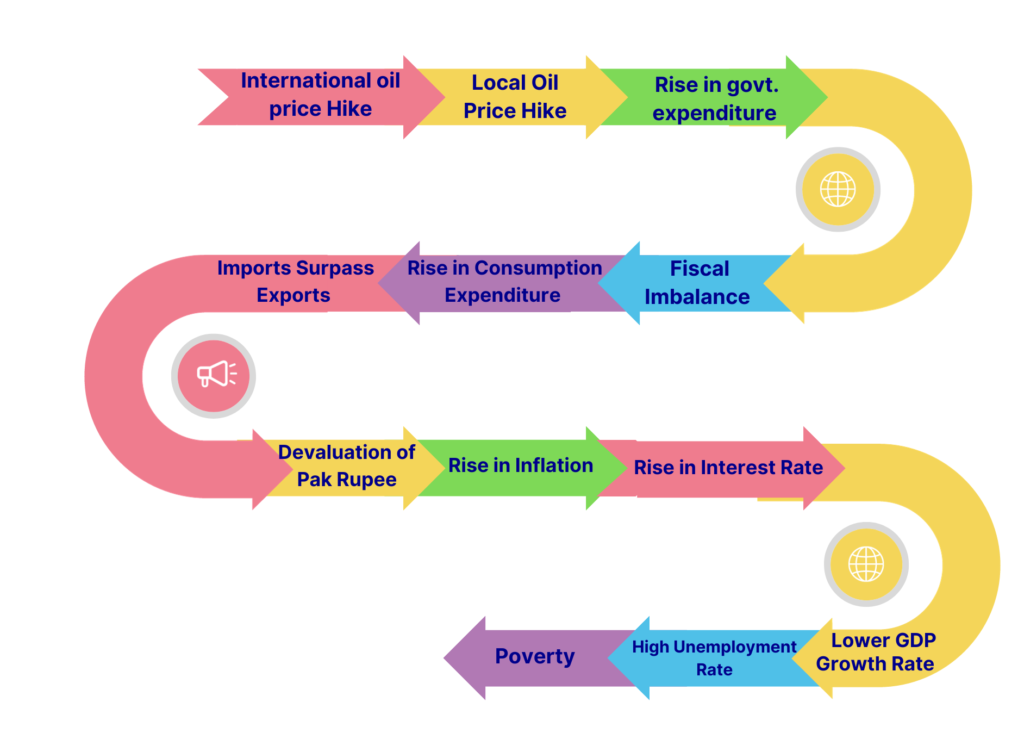

Due to the constant increase in the prices of oil and petroleum products, Pakistan’s economy faces the enormous problem of twin deficits. The concurrent fiscal and current account shortfalls that characterize this dual deficit situation represent a serious obstacle to the efforts by the government to reduce poverty in the country. According to the twin deficit hypothesis, an economic theory, budget deficits frequently occur before current account deficits as a result of government initiatives like tax cuts and increased public spending that boost consumption and lower national savings. The main obstacle is Pakistan’s significant fuel and energy imports, which are exacerbated by rising global oil prices, straining domestic budgets and causing budget deficits. Pakistan’s consumption-oriented economy, which is fueled by low taxation and high government expenditure, has simultaneously increased current account imbalances and currency depreciation, leading to a sizable current account deficit. Rising inflation, high interest rates, difficulty in producing and exporting goods, as well as widespread economic stagnation, unemployment, and poverty, are the end results. A multifaceted long-run approach involving economic diversification, export promotion, import substitution, strategic energy planning, and fiscal reforms is required to break free from this cycle and provide the foundation for Pakistan’s efforts to end poverty and to achieve one of the most important goals of the Sustainable Development Goals (SDGs) of the United Nations (UN).

Introduction

The economy of Pakistan has been significantly and negatively influenced by the ongoing rise in oil and energy costs, which has widened the nation’s current account and budget deficits. This situation, known as the “twin deficit,” in which there are concurrent fiscal and trade shortages, has proven to be a significant obstacle to the country’s growth trajectory. This tendency, where the current account deficit often follows the budget deficit, is known to economists as the twin deficit hypothesis. The observation that higher levels of consumption of imported goods and services occur when earnings improve as a result of government measures like tax cuts and increased government expenditures. The national savings rate significantly declines as a result of the rise in consumer spending and the loss in tax receipts. As a result, the nation borrows money from overseas to finance internal investments and increase its imports to keep up with the growing demand for imported consumer goods and services. A result of higher imports and increasing foreign borrowing is the current account imbalance. The core of this economic dilemma is the complex interplay between the growing current account deficit, which results from lopsided trade dynamics, and the ballooning fiscal deficit, which is caused by government spending exceeding revenue.

Imports of energy and oil are a significant part of Pakistan’s economy. Local energy costs have increased due to rising global oil prices, forcing the Pakistani government to provide subsidies and support rates to avoid any unrest in the population. However, Pakistan’s finances are consistently strained due to having one of the lowest tax-to-GDP ratios in the region. The resulting budget imbalance has widened the gap between government revenue and expenditure by unleashing the threat of inflation and an unmanageable public debt burden.

Pakistan’s low taxation and enormous government expenditure have transformed the country’s economy into a consumption-driven giant. Continuously outpacing domestic production and exports is the unquenchable demand for imported products and services. Due to the imbalance between our exports and imports and the ensuing depreciation of the Pakistani Rupee in relation to the US Dollar, the cost of imported fuel and energy has soared. Although theoretically currency depreciation can boost exports, an economy that relies heavily on imports faces a paradox because depreciation can exacerbate trade imbalances by making imports more expensive. This reliance on imports contributes to Pakistan’s significant current account deficit, which places a significant strain on its foreign exchange reserves and forces it to frequently rely on the IMF to close trade gaps. The recent rise of inflation has caused domestic interest rates to soar to unimaginable heights, rising as high as 22% in recent months. This has had an impact on various industries, increasing the cost of funding for regional investors and businesses. This rising cost structure has hindered Pakistan’s ability to produce and export goods, which has slowed economic growth, increased unemployment, decreased per capita income, increased cost of living, and increased poverty levels.

The complex interplay of rising oil and energy prices, ongoing budget deficits, and relentless current account deficits perpetuates a vicious cycle resulted in sluggish economic growth, pervasive unemployment, increased poverty, and an unstable economic environment. To break free from this cycle and usher in a sustained era of economic prosperity for Pakistan, a comprehensive long-run strategy comprising economic diversification, export promotion, import substitution, strategic energy planning, and cautious fiscal management is urgently required. In the sections that follow, we’ll delve deeper into the particulars of this problem in the particular context of Pakistan and include data tables and graphs to help you completely comprehend the problem.

The Oil Price Hike and the Budget Deficit in Pakistan

International price changes for petroleum products have long had an impact on domestic oil prices in Pakistan. Historically, several governments have kept domestic oil prices low by manipulating the currency rate and providing subsidies. Although the goal of this strategy was to make living costs affordable for the populace, it had unfavorable effects that resulted in a major loss of foreign exchange reserves and the buildup of sizable external debt. As a result, the nation’s ability to support subsidized oil prices gradually declined.

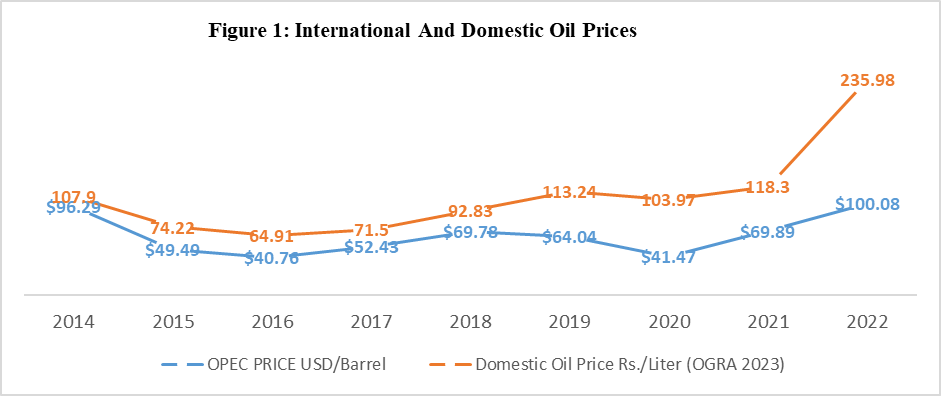

Pakistan was consequently forced to reflect the actual cost of imported oil by bringing domestic oil prices into line with market pricing on a global scale. The rising price of oil on the domestic market has been influenced by this change in policy. Additionally, the government imposed numerous taxes on oil as a result of the urgent need to reduce a ballooning budget deficit, significantly raising the price of this necessary good for the general public. As a result, domestic oil prices kept on rising, as seen in Figure 1, which also shows how both local and global oil prices rose concurrently. The impact of the global oil market on domestic oil prices and the need for taxes to close the budget gap highlight the complex economic dynamics that Pakistan must manage in order to balance its energy requirements and fiscal duties.

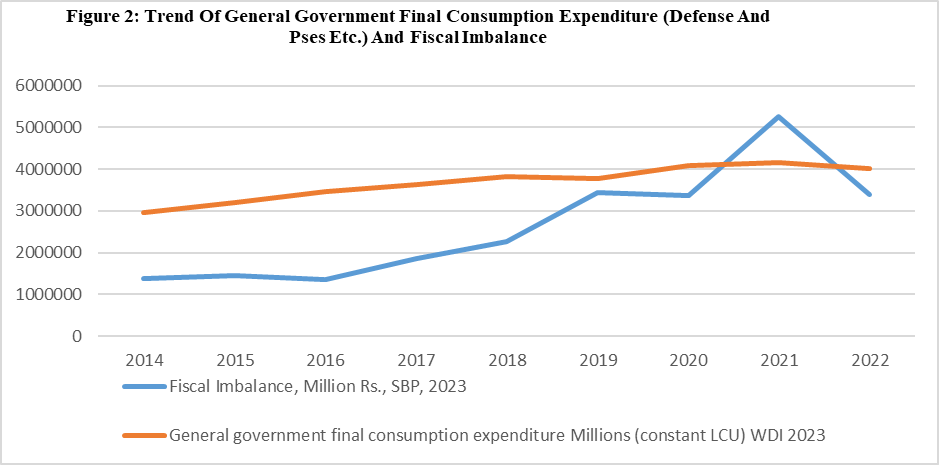

Due to the significant impact that the price of oil has on the national economy, the government has had to spend more money just to maintain operations. The massive military power, the loss-making PSEs, and the ineffective and dishonest bureaucratic apparatus all require enormous amounts of government money to maintain their operations. Huge line losses are being caused by the outdated electrical distribution system, which eventually increases the large circular debt that the government must pay. The problem of circular debt, which would ultimately be paid by the government, was made worse by the elite and powerful, industries, and government offices stealing and failing to pay electrical bills.

If previous administrations and other entrenched interest groups had not entered into an unfair deal with the independent power projects (IPPS), the issue of such a high dependence on imported fuel and petroleum goods would not be as serious. The governments agreed to pay the IPPS in full capacity in foreign money, preferably in US dollars, and gave them the authority to create power from imported fuel. The ruling class, who are the local shareholders in IPPS, would have always been reluctant to invest in affordable and renewable energy, therefore this may also have a political economy component.

As a result, there is a massive budget imbalance and rising government spending. This has been made worse by the state’s unwillingness or inability to impose direct and progressive taxation on the wealthy in accordance with their incomes. Instead, the government always used indirect taxation, such as adding taxes to the cost of petrol, energy bills, food, and other essentials. There is always a limit to how much money people can provide to the government, thus that strategy did not succeed in doing so. All of these factors have contributed to reduced tax collections, rising government spending, and ultimately, the budget deficit. Figure 2 (below), which depicts identical growth patterns for both government spending and the budget deficit, makes this clear.

State Bank of Pakistan (https://www.sbp.org.pk/departments/stats/PakEconomy_HandBook/Chap-3.7.pdf).

The Budget Deficit and the Current Account Deficit in Pakistan

Pakistan’s economic environment has undergone a significant change that has caused it to transform into a consumption-driven economy. This change is supported by a number of elements that have had a substantial impact on the fiscal and trade dynamics of the nation. The chronically low tax-to-GDP ratio and significant government non-developmental spending are key drivers of this trend. These costs include a variety of operational expenses that don’t support long-term economic growth. Pakistan also has to contend with significant interest payments on its domestic and foreign loans. The nation’s borrowing to fund fiscal shortfalls and development initiatives has resulted in exorbitant interest payments. The economic environment of the nation is further characterized by a sizeable number of heavily subsidized Public Sector Enterprises (PSEs) that often operate at a loss and require financial assistance from the government to maintain their operations. Although designed to secure the supply of necessities such as products and services, the subsidies to PSEs have put a pressure on the government’s financial resources.

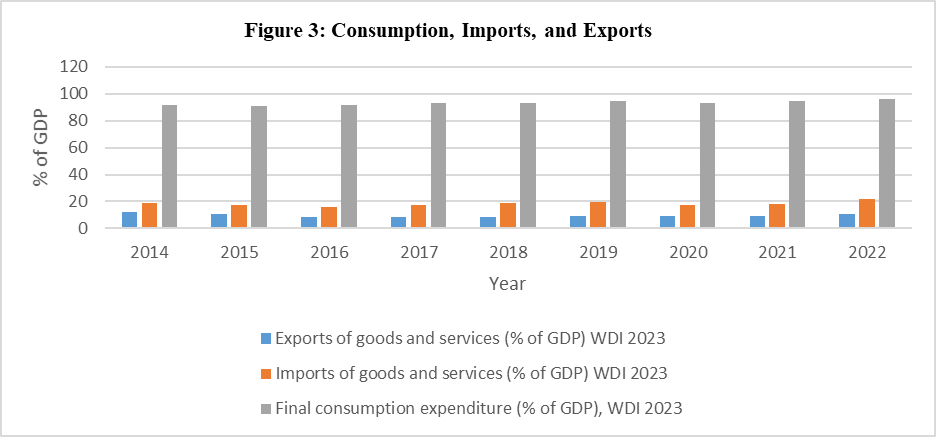

The ongoing discrepancy between foreign demand for Pakistani goods and import demand is a key factor in this shift to a consumption-driven economy. Current account deficits have been constant and significant as a result of this trade imbalance. The Pakistani rupee (PKR), the country’s official currency, and the foreign exchange reserves are both significantly under pressure from the country’s ongoing current account deficit. Pakistan has frequently turned to the International Monetary Fund (IMF) for assistance as a result of these economic imbalances. To address the issues brought on by the current account deficit and stabilize the nation’s economic status, the IMF’s financial assistance and policy recommendations have been sought. The dominance of private and public consumption expenditures in Pakistan’s economy is graphically depicted in Figure 3. Additionally, it emphasizes the ongoing trend of imports outpacing exports, emphasizing the economic difficulties brought on by the current account deficit. In conclusion, Pakistan’s transition to a consumption-driven economy is the result of a number of interrelated factors, such as the low tax-to-GDP ratio, high non-developmental spending by the government, significant interest payments on domestic and foreign debts, and the existence of highly subsidized but ineffective PSEs. In addition to changing the country’s economic priorities, these factors have also caused a recurring current account deficit, which has an effect on foreign exchange reserves and the national currency.

Rupee Depreciation, Inflation, and the Rate of Interest in Pakistan

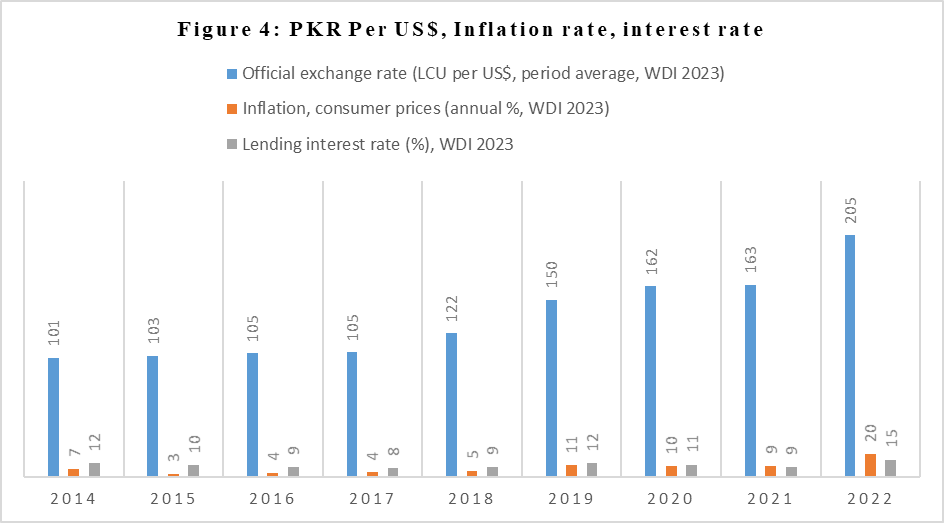

The value of the Pakistani Rupee (PKR) in relation to the US Dollar (USD) underwent severe downward pressure as a result of the shift to a consumption-driven economy. The PKR’s depreciation, coupled with the sharp increase in domestic oil prices and the ongoing increase in indirect taxes, has created a marked and persistent inflationary environment in the nation. The cost of living for average people increased dramatically, placing a strain on the stability of the national economy as inflationary pressures reached an all-time high.

One of the notable effects of the PKR’s continuous depreciation and the inflation’s sharp rise was a significant rise in interest rates throughout the economy. Figure 4 clearly illustrates this phenomenon by highlighting the connection between the depreciation of the PKR, the spike in inflation, and the subsequent increase in interest rates. Both consumers and businesses are impacted by the rising interest rates’ effects on the cost of borrowing and the soundness of the financial system.

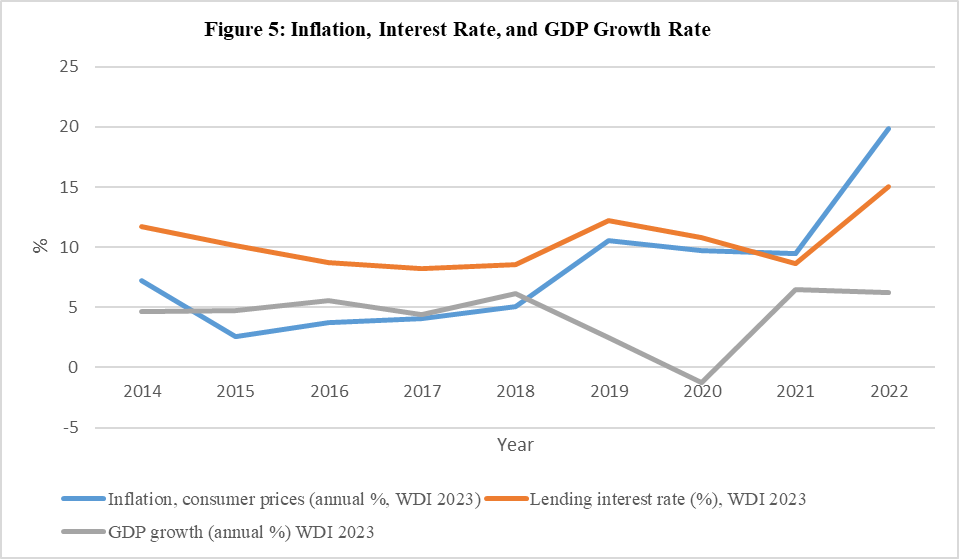

Poverty

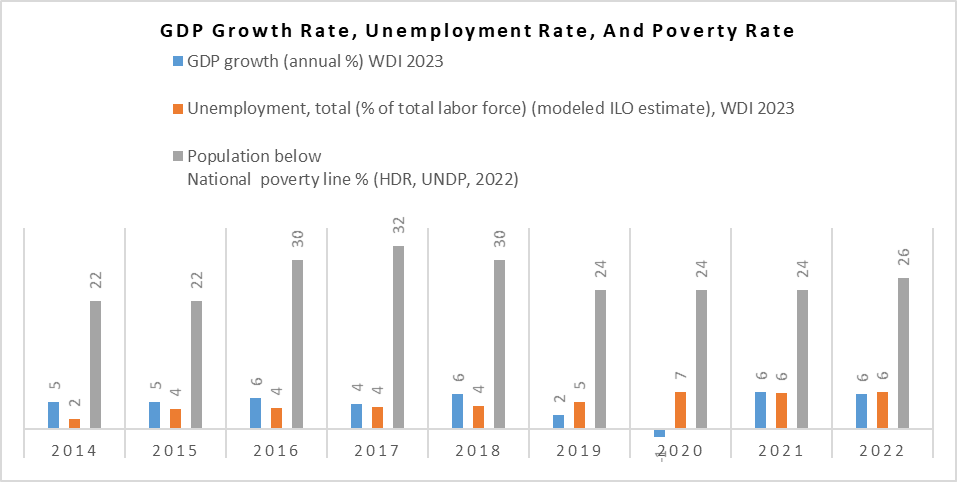

The effects of the increase in oil prices, in addition to the budget and current account deficits, have resulted in an increase in the poverty levels in Pakistan. High interest rates and the ongoing depreciation of the Pakistani Rupee (PKR) amplify the negative effects of these economic difficulties. The economic growth rate has significantly slowed as a result of this dynamic. They are not possible nor lucrative due to the enormous costs involved in funding investment projects in a setting with such high interest rates. For local investors and manufacturers, the depreciated PKR has also increased the costs associated with importing capital goods and machinery, creating a considerable barrier. Additionally, the country’s exports have decreased as a result of the rising energy costs, which have made local goods less competitive on the global market. As a result, Figure 5 shows that the rate of total economic growth has significantly slowed down. Wide-ranging effects of this slowdown in economic growth include a drop in an increase in unemployment rates and a rise in poverty levels. Figure 6 emphasizes the connection between these crucial development indicators, underlining the necessity for long-run strategic policies and measures to counteract these negative consequences and promote sustainable development in Pakistan.

Conclusion

The serious problems brought on by Pakistan’s rising levels of poverty, rising oil prices, budget deficit, and current account deficit have been underlined in this research. It needs a multifaceted strategy that includes rigorous long-run economic planning, economic diversification, and responsible budgetary management to overcome these obstacles. There is a vicious loop that links the rise in the price of oil with the budget and current account deficits, as well as with the rising poverty levels that results. Short-term austerity measures cannot end this vicious cycle. Only temporarily do the short-term solutions fix the problem. Every few years, the cycle repeats, and the nation always turns to the IMF and other friendly nations for financial assistance. Long-term planning is required to end the vicious cycle. Government should make investments in human capital to turn people into assets rather than liabilities. By making investments in affordable and sustainable local energy resources, the reliance on imported oil and energy products may be reduced. To solve the budget deficit issue, the government’s non-developmental spending needs to be rationalized, and the revenue base needs to be widened. To relieve the poor of the heavy burden of indirect taxation and replace it with a direct progressive system of taxation, more wealthy individuals and businesses should be included in the tax system. To ensure the enforcement of contracts and property rights, the institutional structure should be made effective and available. To attract enterprises working in the informal sector of the economy to register themselves in the formal sector of the economy, institutional processes should be made simpler and faster.

***

Download The Vicious Cycle of Oil Price Hike, Budget Deficit, Current Account Deficit, and Poverty in Pakistan Report-I 2023 in PDF Format.

Thank you for sharing this report. It is well-written and informative. This report highlights the challenges that Pakistan’s economy is facing due to the constant increase in the prices of oil and petroleum products. The twin deficits, which are the concurrent fiscal and current account shortfalls, represent a serious obstacle to the efforts by the government to reduce poverty in the country. This report also explains the twin deficit hypothesis, which is an economic theory that budget deficits frequently occur before current account deficits as a result of government initiatives like tax cuts and increased public spending that boost consumption and lower national savings.

This Report Absolutely Amazing….Keep Shining_🌟

Thank You Dear Ahmad Khan

What a wonderful and insightful report. Maintain your wonderful work. Respected Sir, Dr. Sajjad Ahmad Jan, and Dr. Fahim Nawaz will always be there for you, no matter where you need us.

Highly energetic blog, I liked that bit. Will there

be a part 2? https://bandurart.mystrikingly.com/

Highly energetic blog, I liked hat bit. Will there be a part 2? https://bandurart.mystrikingly.com/

I just like the valuable info you provide in your articles.

I will bookmark your weblog and test once more here frequently.

I’m reasonably certain I will be told many new stuff right

right here! Good luck for the next!